Property owners in Australia have access to various types of insurance products tailored to meet their specific needs. Among these, Holiday House Protection and Landlord Insurance are two distinct types of cover designed for different purposes. Understanding the differences between these insurance options is essential to ensure your property is adequately protected.

What Is Holiday House Protection?

Holiday House Protection is a type of insurance designed specifically for properties used as holiday homes or short-term rental accommodations. These properties are typically rented out through platforms like Airbnb, Stayz, or Booking.com, or are occasionally used by their owners for personal leisure.

Key Features of Holiday House Protection:

- Short-Term Rental Cover:Protects against risks associated with short-term tenants, who often rotate frequently and may have limited vetting compared to long-term tenants.

- Damage to Contents:Covers furniture, appliances, and other items provided for tenant use.

- Liability Insurance:Includes public liability coverage in case a guest is injured on the property or causes damage to neighboring properties.

- Loss of Income:Some policies cover lost income if the property becomes uninhabitable due to an insured event, such as a fire or storm.

- Flexibility for Owner Use:Accommodates scenarios where the owner uses the property for personal holidays without voiding the policy.

What Is Landlord Insurance?

Landlord Insurance is specifically designed for properties rented to long-term tenants under a formal lease agreement. It provides coverage tailored to the risks associated with being a landlord.

Key Features of Landlord Insurance:

- Rental Income Protection:Covers loss of rental income due to tenant default, lease-breaking, or if the property becomes uninhabitable due to an insured event.

- Building and Contents Cover:Protects the building itself and any fixtures or contents provided to tenants (e.g., carpets, light fittings).

- Legal Liability:Provides liability coverage if someone is injured on the property.

- Tenant-Related Risks:Covers malicious damage caused by tenants, as well as accidental damage in some cases.

- Legal Expenses:Includes costs associated with pursuing legal action against a tenant for unpaid rent or damage to the property.

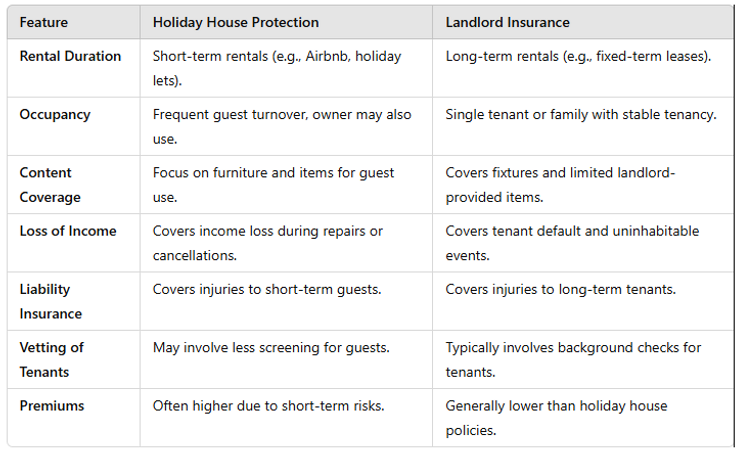

Comparing Holiday House Protection and Landlord Insurance

Why the Difference Matters

The purpose and usage of the property are crucial in determining the right insurance policy:

- Choose Holiday House Protection if your property operates as a short-term rental or holiday accommodation. This policy accounts for high guest turnover and the unique risks of short stays.

- Choose Landlord Insurance if you lease your property under a long-term rental agreement. These policies focus on the risks of stable tenancy arrangements.

While both types of insurance offer protection for property owners, they are tailored to meet different needs. It’s essential to evaluate your property’s use and rental arrangements before choosing a policy. Consulting with a licensed insurance broker can help ensure you have the appropriate cover for your circumstances.

Whether you own a beachside holiday house or an urban rental property, investing in the right insurance policy provides peace of mind and financial security.

Want to know more?

If you’d like to discuss any of the content in this article and how it may apply to you, please call me on 1800 668 153.

You can also book a discovery call thru our live calendar.

We love hearing from our readers! Please send us your questions, feedback or interest topic by clicking here.

Author Profile: Jeffrey Liu, JP, is the founder and principal adviser of Hippo Insurance (aka: Hippo Wealth), with a deep expertise in wealth protection. His extensive experience includes roles in the wealth management divisions of Westpac, ANZ, and a local multi-family office. As the host of “Riches Talk,” a podcast dedicated to cultivating personal and business growth, Jeffrey has established himself as a thought leader in developing life riches. His insights have been featured on SBS, The Australian, and Channel 7. Notably, he was a semi-finalist on Australia’s Got Talent in 2010. Learn more at http://www.hippoinsurance.com.au