ASIC recently looked into how superannuation funds and financial advisers handle investments in super and communicate with members and clients about their super performance. Their findings show that there’s room for improvement in both areas.

According to ASIC’s research conducted in late 2023, nearly 3 in 10 Australians only check their super’s performance once a year or never at all. That’s why it’s important for people to start paying more attention to their super.

If your employer pays your super into the fund they chose for you, you probably have a MySuper account. MySuper accounts generally have low fees and a balanced investment strategy meant to grow your super investments throughout your working life.

Super funds also offer other investment options, known as ‘choice’ super products, where you actively choose where your super is invested instead of sticking with the default MySuper option. Sometimes, these choices are recommended by a financial adviser if you have one.

It might not always be top of mind to check your super’s performance when you’re busy, but taking a little time to do so regularly can make a big difference in the long run.

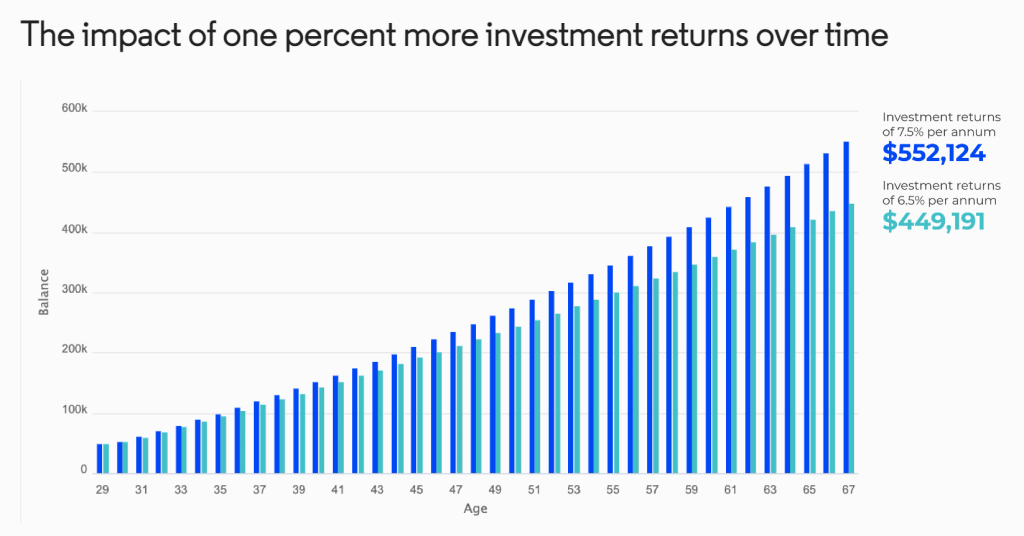

Using Moneysmart’s superannuation calculator, you can see the impact of different investment returns on your future lifestyle. For example, comparing a super fund’s investment option with average returns of 7.5% per year to one with returns of 6.5% per year for someone who’s 30 years old. While a 1% difference may not seem significant, over a lifetime, it could mean having over 20% more super at retirement. This could affect your ability to travel, socialize, and afford aged care.

Image source: https://moneysmart.gov.au/media-centre/news-get-more-from-your-super

Ensuring you’re getting the most out of your super doesn’t have to be complicated. Here are three simple actions you can take to make sure you’re on the right track:

- Know Your Super: Take the time to understand your super by exploring your fund’s website, app, or simply giving them a call. Ask questions to learn about your current investments, available insurance options, and any other features your fund offers. Don’t forget to compare your fund with others to ensure you’re getting the best deal.

- Stay Engaged: Don’t just set and forget your super. Regularly monitor how your super investments are performing compared to their targets. Consider whether your current investment option is still the best fit for your goals. Check out our handy tips on choosing the right super fund to guide your decisions.

- Seek Advice: If you have a financial adviser, lean on their expertise to assess your super’s performance. Ask about your super’s short and long-term performance and whether you’re on track to achieve your retirement goals. Explore potential alternative options and discuss any tax or insurance implications of making changes.

Remember, how you manage your super is a personal decision. By arming yourself with knowledge, you’ll be better equipped to make informed financial choices regarding your retirement savings.

Don’t leave your superannuation to chance – take control of your financial future today.